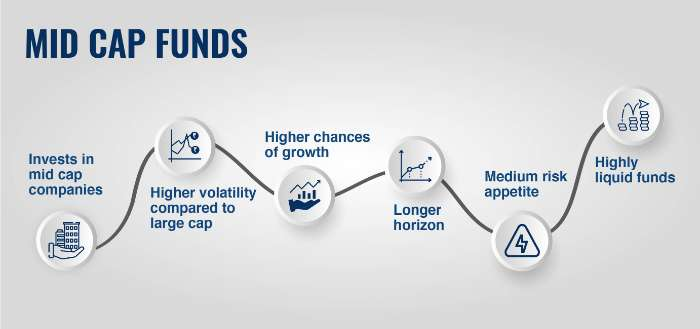

Most of the time, mid-cap companies are the companies with a lot of growth potential that have already proven the stability of their business by reaching a certain level in their industries, but these companies still can grow more. Investing in the dsp mutual fundmay enable investors to gain access to these vibrant companies, and consequently, they may have better chances to make profits from the future successes of these firms. The Fund is able to diversify across a basket of carefully chosen mid-cap stocks, which in turn provides an unmatched opportunity for investors to share in the growth stories of some of India’s most promising businesses.

- Experienced Fund Management

DSP Midcap Fund Direct Growth is run by a group of experienced professionals who have a thorough knowledge of the middle capital class segment. In-depth research and thorough analysis of the companies in their portfolio are done to ensure that the fund’s holdings are carefully selected, given that these companies are known to have strong fundamentals, competitive advantages and positive growth prospects. This fund takes advantage of the experience of its managers in choosing and investing in promising businesses with a view to maximizing profit in the long term and generating handsome returns for its investors.

- Diversification and Risk Management

Large mid-cap stock investment is in itself risky because of the volatility typically common to this segment. Nonetheless, the featured DSP Midcap Fund Direct Growth takes a diversified angle, investing in mid-cap companies from different sectors and spreads the investments across the various sectors. This diversification, in turn, helps companies to avoid concentrating on one specific factor and to achieve a smoother level of performance that is more balanced towards the mid-cap sector.

- Long-Term Wealth Creation Potential

Small and mid-cap companies usually are in growth phase, which provides a great opportunity to increase their operations, penetrate new markets and establish themselves as large players in the market. The dsp midcap fund as direct growth investment opportunity has the potential of benefiting investors from the long term value creation of these companies as they mature and may possibly transition into large caps. This fund, in turn, provides you with a chance to benefit from the high growth potential of promising mid-cap companies that are likely to yield huge returns in the long term.

- Tax Efficiency

The DSP Midcap Fund Direct Growth can be considered to be a tax efficient investment because of the advantage it provides. The direct growth plan which investors can use can potentially minimize the influence of distributor commissions and other distribution-related costs. In short, this means that the fund’s investors enjoy higher capital gains and superior overall performance as the compound effect of reinvesting a large part of returns is in play.

Conclusion

When it comes to financial markets which are constantly changing, DSP Midcap Fund Direct Growth is a fund that could be the perfect choice for those who are looking for long term growth and diversification. The fund has a group of expert fund managers, portfolio that is well-diversified and a tax-efficient structure. This fund opens up the opportunity for mid-cap investing to a new world. The dsp midcap fund direct growth Fund would certainly be an investment worth looking into for those people who might be looking to take advantage of the growth stories of the emerging Indian mid-market companies. The first step is to get on the platforms, especially the 5paisa, that have the widest array of mutual funds, including the DSP Midcap Fund Direct Growth.