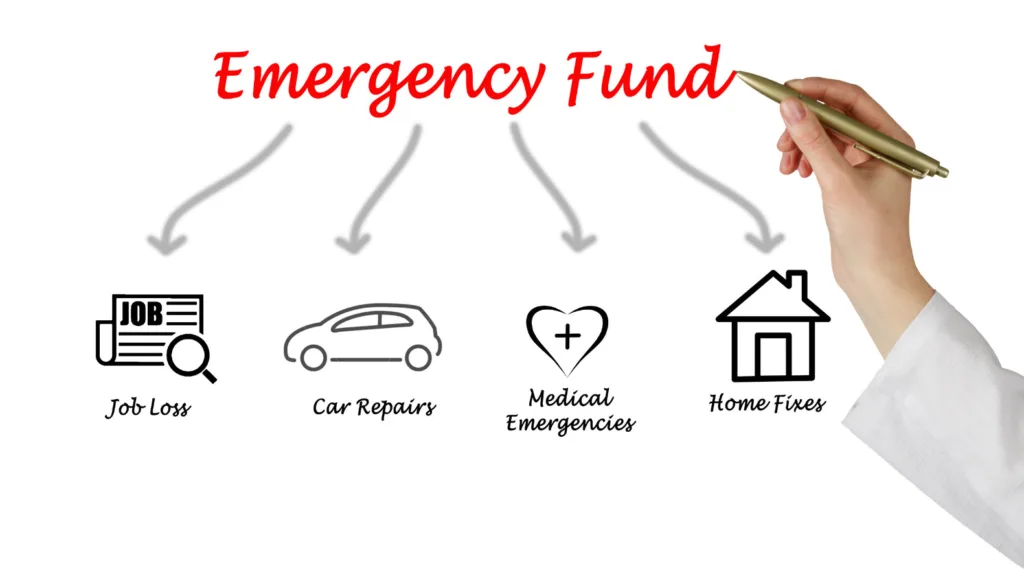

Life has a way of throwing curveballs when you least expect them. Whether it’s a sudden job loss, an unexpected medical bill, or an urgent car repair, these surprises can quickly turn your finances upside down. That’s where an emergency fund comes in. Think of it as your personal insurance policy—a safety net that allows you to handle life’s unexpected events without falling into debt. Whether you’re saving for a rainy day or considering North Carolina title loans as a backup plan, having an emergency fund can make all the difference.

What Exactly Is an Emergency Fund?

An emergency fund is a stash of money set aside specifically to cover unexpected expenses. Unlike regular savings, which might be earmarked for a vacation or a new car, an emergency fund is there for those “just in case” moments. It’s not for day-to-day expenses or planned purchases—it’s your financial buffer for when life doesn’t go according to plan.

The idea is to have enough money saved to cover a few months of living expenses, such as rent or mortgage payments, utilities, groceries, and other essentials. The goal is to be able to maintain your standard of living, even if your income suddenly stops or an emergency arises.

Why an Emergency Fund Is Essential

Having an emergency fund is about more than just peace of mind—it’s about protecting your financial future. When unexpected expenses pop up, they can put a serious strain on your budget, especially if you’re living paycheck to paycheck. Without an emergency fund, you might find yourself relying on credit cards, payday loans, or even North Carolina title loans to make ends meet.

While loans can provide short-term relief, they also come with interest and fees that can add up quickly, potentially leading to a cycle of debt. An emergency fund, on the other hand, allows you to cover unexpected costs without going into debt, keeping your finances stable and your stress levels low.

How Much Should You Save?

One of the most common questions about emergency funds is, “How much should I save?” The answer depends on your individual circumstances, but a good rule of thumb is to aim for three to six months’ worth of living expenses. If your job is unstable or you work in a field with a higher risk of layoffs, you might want to aim for six months or even more.

To figure out how much you need, start by calculating your essential monthly expenses—things like rent or mortgage, utilities, groceries, insurance, and any minimum debt payments. Multiply that amount by the number of months you want to cover. For example, if your essential expenses total $2,000 per month, you should aim to have between $6,000 and $12,000 in your emergency fund.

Building Your Emergency Fund: Start Small, Think Big

Saving a large amount of money can feel overwhelming, especially if you’re starting from scratch. But remember, you don’t have to save it all at once. Start small and build your emergency fund gradually over time.

Here are some tips to help you get started:

- Set a Savings Goal: Break your target amount into smaller, more manageable goals. For example, aim to save $500 first, then work your way up to $1,000, and so on. Each milestone you reach will give you a sense of accomplishment and motivate you to keep going.

- Automate Your Savings: One of the easiest ways to build your emergency fund is to set up automatic transfers from your checking account to a savings account. By automating the process, you ensure that you’re consistently contributing to your fund without having to think about it.

- Cut Back on Non-Essentials: Take a close look at your budget and identify areas where you can cut back. Whether it’s eating out less, canceling unused subscriptions, or finding cheaper alternatives for everyday expenses, every little bit helps.

- Use Windfalls Wisely: If you receive unexpected money, such as a tax refund, bonus, or gift, consider putting it directly into your emergency fund. This can give your savings a significant boost without affecting your day-to-day budget.

Where to Keep Your Emergency Fund

Where you keep your emergency fund is almost as important as saving it in the first place. You want your money to be easily accessible in case of an emergency, but not so accessible that you’re tempted to dip into it for non-emergencies.

A high-yield savings account is a good option because it offers easy access to your funds while earning some interest. Money market accounts or a traditional savings account are also suitable choices. Avoid keeping your emergency fund in stocks, mutual funds, or other investments that could lose value or take time to liquidate.

When to Use Your Emergency Fund

Knowing when to tap into your emergency fund is key to making sure it lasts. An emergency fund should only be used for true emergencies—situations where not having the money would put your financial stability at risk.

Examples of appropriate uses include:

- Unexpected Job Loss: If you lose your job, your emergency fund can help cover living expenses while you look for new employment.

- Medical Emergencies: Unplanned medical bills, especially those that are not fully covered by insurance, are a legitimate reason to dip into your fund.

- Major Car Repairs: If your car breaks down and you need it for work, using your emergency fund to cover the repair costs makes sense.

On the other hand, a sale on a big-screen TV or a last-minute vacation deal doesn’t qualify as an emergency. Be disciplined about what constitutes an emergency and resist the urge to use your fund for anything else.

Rebuilding After an Emergency

If you’ve had to use your emergency fund, the next step is to start rebuilding it as soon as possible. Go back to the basics—set new savings goals, automate your contributions, and make rebuilding your fund a priority in your budget.

The good news is that once you’ve established the habit of saving, rebuilding your emergency fund will likely be easier than starting from scratch. Keep in mind that life is unpredictable, and having a fully funded emergency fund is your best defense against future financial shocks.

Conclusion: Your Financial Lifeline

An emergency fund is more than just a nice-to-have; it’s a financial lifeline that can help you weather life’s storms without derailing your long-term goals. Whether it’s the peace of mind that comes from knowing you’re prepared for the unexpected or the ability to avoid debt in a crisis, the benefits of having an emergency fund are clear.

Start building your emergency fund today, and think of it as your personal safety net—ready to catch you when life takes an unexpected turn. With a solid emergency fund in place, you’ll be better equipped to handle whatever comes your way, whether it’s covering an unexpected expense or avoiding the need for quick solutions like North Carolina title loans. In the end, a well-funded emergency account is not just about surviving tough times; it’s about thriving despite them.