In today’s digital age, the role of cybersecurity technology in banking cannot be overstated. As online banking and financial transactions become increasingly prevalent, so do the threats that aim to compromise the security of these systems.

Cybersecurity technology plays a pivotal role in safeguarding the integrity, confidentiality, and availability of financial data and services. Here, we explore the key aspects of how cybersecurity technology contributes to the safety of banking operations.

Key Takeaways

- Banks continuously evolve their cybersecurity strategies to counter new threats.

- Artificial intelligence and machine learning are harnessed to identify and respond to anomalies.

- Threat intelligence sharing enhances the industry’s collective defense against cyberattacks.

- Regular security audits and penetration testing are crucial to assess vulnerabilities.

- Customer awareness and education remain pivotal in the fight against cyber threats.

Safeguarding Customer Data

One of the primary responsibilities of cybersecurity technology in banking is to safeguard customer data. This includes personal information, account details, and transaction history.

In an era where data breaches are a constant threat, banks must employ robust security measures to protect this sensitive information. Firewalls, intrusion detection systems, and encryption protocols are implemented to create a secure digital environment.

Securing Online Transactions

The heart of modern banking lies in online transactions. Customers expect seamless and secure access to their accounts and the ability to conduct transactions from anywhere.

Cybersecurity technology ensures that online banking platforms are fortified against threats like phishing attacks and malware. This is why Orlando managed IT services focus on different security processes to identify new vulnerabilities, risks, and threats and constantly adapt to ensure system and data security. Multi-factor authentication methods add an extra layer of security, verifying the identity of users and preventing unauthorized access.

Implementing Proactive Measures

Cyber threats are continually evolving, making it essential for banks to stay one step ahead. Security teams employ proactive measures to identify vulnerabilities and potential risks.

Continuous monitoring of network traffic and behavior analysis help detect anomalies that might indicate a security breach. By identifying threats early, banks can take swift action to mitigate potential damage.

Educating Stakeholders

While technology is a critical component of cybersecurity, educating bank staff and customers is equally important. Employees need to be aware of best practices for handling sensitive information and recognizing potential threats. Customers should also be educated about safe online banking practices to protect their accounts and personal data.

Harnessing Artificial Intelligence and Machine Learning

Banks are increasingly turning to artificial intelligence (AI) and machine learning (ML) to bolster their cybersecurity efforts. These technologies have the capability to analyze vast amounts of data in real-time, allowing for the rapid detection of anomalies and suspicious activities. AI-driven solutions can identify patterns that might be indicative of a cyberattack and trigger automated responses to mitigate the threat.

Collaborative Threat Intelligence Sharing

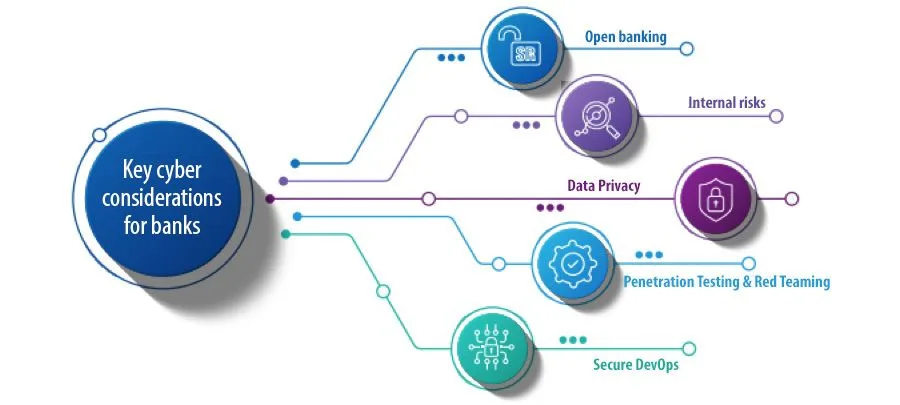

The banking industry understands the importance of collaboration when it comes to cybersecurity. Threat intelligence sharing among financial institutions has become a powerful tool in the fight against cyber threats.

By sharing information about new attack vectors, malware strains, and vulnerabilities, banks can collectively strengthen their defenses and respond more effectively to emerging threats.

Continuous Security Audits and Penetration Testing

Regular security audits and penetration testing are essential components of a robust cybersecurity strategy. Banks proactively assess their systems and networks for vulnerabilities, allowing them to address weaknesses before they can be exploited by malicious actors. Penetration testing simulates real-world cyberattacks, helping banks understand their preparedness and response capabilities.

Customer Awareness and Education

While technology plays a vital role in cybersecurity, customer awareness and education remain paramount. Banks invest in educating their customers about safe online practices, recognizing phishing attempts, and protecting their personal information. Customers who are well-informed are less likely to fall victim to cyberattacks, making this a critical aspect of cybersecurity strategy.

Conclusion

In conclusion, as the banking industry continues to embrace digital transformation, cybersecurity remains a cornerstone of its success. Part 2 has highlighted how banks harness cutting-edge technologies, collaborate with industry peers, and prioritize customer education to fortify their defenses.

The dynamic nature of cyber threats requires a proactive and adaptive approach, ensuring that banks can protect their assets and maintain the trust of their customers.